What is Cross Cheque – Why do we strike two lines at corner of cheque

If you are actively dealing in bank transactions on regular basis, you might have been presented with the cheque with your name on it and two cross lines indicated on it.

Ever wondered what do the two lines striked at the corner of cheque indicate?

These lines are drawn for specific purpose. They give instructions to bank regarding the payment to payee. Cross cheque indicates the payment should be made with transfer to the account.

What is purpose of cross cheque?

When the drawer wants to make sure the amount is securely paid to only to the intended beneficiary only.

These two parallel lines also signify that the payment should not be made on cash basis.

Hence you won’t receive payment in cash at any condition. You must deposit the cheque by attaching deposit slip.

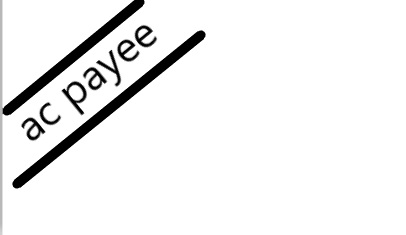

In case the crossing is made with words ‘account payee’ written on it, then banks must make payment to the account of the payee name mentioned on the cheque only. You get protection under Negotiable Instrument Act making your payment more secure.

The cross cheque is significantly important when you are paying someone for the service or any other liability that you are holding.

This is because when the cheque is deposited to their account, The payment will be recorded in electronic form in the statement of payee’s account. The person receiving payment can’t deny receiving payment.

What if the cheque is of different bank and you hold account in some other bank?

In such case you have to visit your own branch and fill up the deposit slip with particulars of your account and cheque number. The cheque will be cleared through CTS or through local clearing.

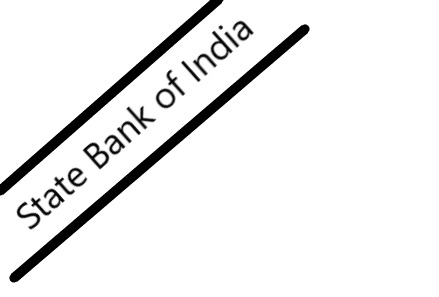

However, it is only possible if the crossing does not mention the bank name. For example consider following type of crossing on the cheque.

Here the drawer has mentioned the name of bank as ‘State Bank of India’ between the two parallel lines. Therefore the payee will get payment in his account maintained with SBI only. This kind of crossing can also be combined with other instructions such as in addition of ‘account payee’ or ‘not negotiable’ with name of the bank.