Yes Bank RTGS & NEFT form

Yes bank is one of the top private sector bank in India. The bank founded in 2004 and its headquarter is in Mumbai. The Yes bank provide wide range of financial and banking facilities for Retail & Corporate customer including net banking service, fund transfer using RTGS and NEFT form.

RTGS (Real time Gross Settlement) and NEFT (National electronic Fund Transfer) is a digital money transfer service, both the RTGS/NEFT service are maintained by RBI(Reserve bank of India). Using RTGS form customer transfer fund on real-time basis which means within 30 min you will receive transfer amount.

Table of Content

1. How to fill RTGS/NEFT Form

2. RTGS/NEFT Fund Transfer Limit and Charges

3. Yes bank Timing for RTGS/NEFT service

How to fill Yes Bank RTGS/NEFT Form

Almost all the banks have similar process for form filling and it’s available in different languages. RTGS form available offline as well online, you can download online form through email or visit Yes bank home branch. You can follow given steps to fill Yes bank RTGS/NEFT form.

The form consist three parts:

1. Beneficiary Details

2. Remitter’s Details

3. Acknowledgement Receipt

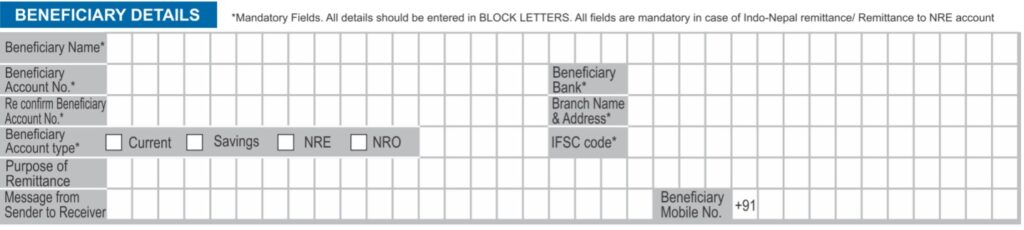

Beneficiary’s Details

Fill up the detail of the beneficiary as follows

- Beneficiary Name

- Beneficiary’s Account Number

- Beneficiary’s Account Type

- Reconfirm Ac No

- Bank Name & Branch

- IFSC code

- Purpose of Remittance

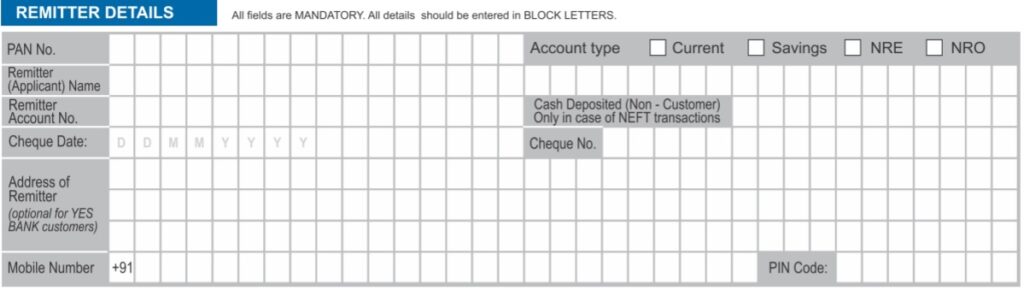

Remitter’s Details

The section contain the details of sender i.e customer which send the amount.

- Remitter’s Name

- Remitter’s Account Number

- Cash Deposited(Non-Yes bank customer)

- Mobile number

- Address of Remitter

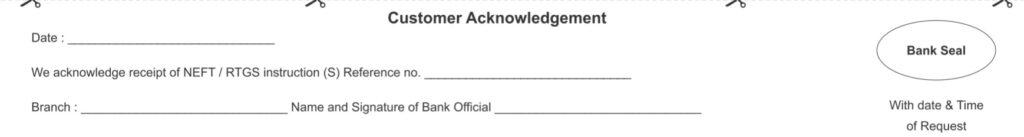

After filling up both the details you will have to submit RTGS/NEFT for to the bank. In the return bank will provide you acknowledgement receipt, which can use it for any complaint regarding transaction.

RTGS/NEFT Fund Transfer limit and charges

Nowadays customer can make RTGS/NEFT to transfer money online and for offline visit nearest Yes bank branch. RTGS is used for transferring a high volume of fund in the least amount of time. The minimum amount to transfer money through RTGS service is Rs. 2 Lakh. The charges for RTGS service as below.

2 Lakhs to 5 Lakhs – Rs 25 per transaction

Above 5 Lakhs – Rs 50 per transaction

NEFT service is used to transfer money from one bank to another bank or for the same bank. The minimum amount to transfer money through NEFT service is Rs. 1 Lakhs.The charges apply for NEFT as below.

Rs 10,000 to 1,00,000 – Rs 5 per transaction

1 Lakhs to 2 Lakhs – Rs 15 per transaction

Above 2 Lakhs – Rs 25 per transaction

For Net banking, mobile banking customer free RTGS/NEFT service is available.

Yes Bank Timing for RTGS/NEFT service

RTGS Timing– Yes bank RTGS timing is Monday to Friday 8 AM to 3:30 PM and on Saturday 10 AM to 3:30 PM. Customers can also download the RTGS/NEFT form here.

NEFT Timing– Yes bank NEFT timing is Monday to Friday 8 AM to 6:30 PM and on Saturday, Sunday and official holiday service is not availble. You can also use NEFT service online 24*7.