PNB Credit Card: Login, Registration Eligibility Criteria, Features & Benefits

Due to digital technology, the banking activities shifted to internet or mobile banking. Punjab National Bank(PNB) offers easy way to access credit card details with online login. The bank provides various credit card to their customer, each credit card is designed to fulfill the requirement of customers as per their usuage.

Let’s see complete detail’s regarding Punjab National Bank(PNB) credit card services, digital app and online portal for direct login to view credit card statement and transaction details.

1.How to Apply for Punjab National Bank Credit Card

2.PNB Credit Card Eligibility Criteria & Documents Required

3. How to login Online for PNB Credit Card

4. PNB Credit Card- Features & Benefits

5. PNB Credit Card Customer Care

How to Apply for PNB Credit Card

Most of the times, bank prefers to allot credit cards to the customers who have existing salary account with the bank. If you are an existing customer then you can apply for credit card by visiting Punjab National Bank home branch and demanding for application form for Credit card.

- Download Punjab National Bank credit card application form directly from the below given link

2. After downloading the form, you have to fill it completely without leaving any of the details. Attach self signed Aadhar card, PAN card Xerox along with the application.

3. If in case the address does not match with your present address, then you have to submit the proof of present address. This could include your driving license, Voter ID, Passport or any other valid document that verifies your current place of residence.

After attaching proper documents along with credit card application form you will have to submit the same to your base PNB Bank branch.

PNB Credit Card Eligibility Criteria & Documents Required

The eligibility criteria for credit card is almost same for all the banks but you have to fullfill certain parameter which are as follow

- He/she must be an Indian national citizen.

- The applicant age is between 21-65 at the time of application.

- If the applicant is self employed, then minimum annual income is not less than Rs.3 Lakh.

Also the documents required for credit card application process are given below

| Address Proof | Aadhar card, Ration card, Electricity bill, Telephone bill, Passport etc |

| Identity Proof | Voter ID card, PAN card, Ration card, Driving license, Aadhar card |

| Income Proof | Salary slip’s, employment letter, Recent ITR, etc |

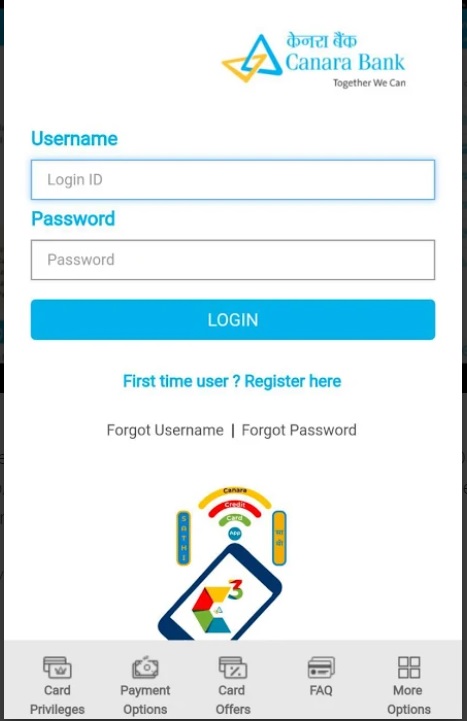

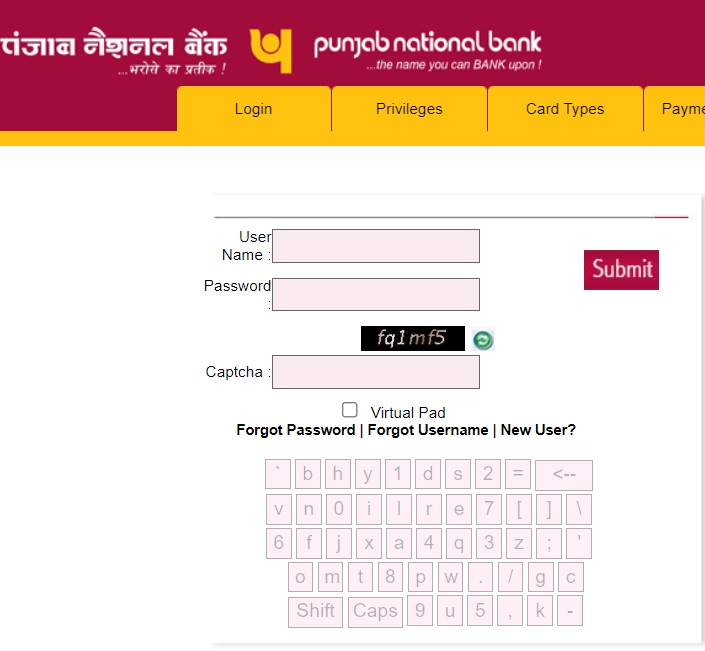

How to Login Online for PNB Credit Card

For managing banking transactions related to your card, you can download PNB Genie app or use https://pnbcard.in/form/login.jsp to login through desktop.

1: Visit the official website of PNB bank i.e www.pnbindia.in

2: Now you have to enter your username and password along with captcha code and click on the login button.

3. If you are ‘New User‘ then you have to complete the registration process and you can login to your credit card online.

PNB Credit Card- Features & Benefits

- RuPay select credit card

- PNB RuPay credit card is basic version of credit card available. The RuPay select credit card offers cashback on utility bills, restaurant expenses and comprehensive insurance package. The credit card provide travel benefits such as complimentry international and domastic lounge access.

- Minimum entry fee- Rs. 500 or annual fee- NIL

- You can get 300+ reward point on first usuages and 2X reward point on retail merchandise.

- Complimentry international and domestic lounge access

2. RuPay Platinum credit card

- PNB RuPay Platinum credit card is co-partnered credit card which offer benefit like reward point, cashback on utility bill, insurance benefits with zero joining fees.

- No entry fees or annual fee

- You can get 300+ reward point on first usuage.

- comprehensive insurance coverage.

3. Global Platinum credit card

- PNB Global Platinum credit card offers various services and product to enhance convenience in your lifestyle.You can get reward point when you spend it on shoping, travel, dining, entertainment etc.

- You can earn 2 reward point on every Rs. 150 spend.

- Available emergency services like medical support, roadside assistance and patient travel arrangement etc.

- concierge services.

4. Global Gold credit card

- PNB Global Gold card is international credit card which comes with multiple purchase and privileges. You can get benefits on shopping, travelling, dining etc.

- You can earn 1 reward point on Rs. 100 and get exciting offers from the exclusive reward point.

- Global Gold credit card get up to 2 add-on cards for family members (over 18 year).

- PNB Global Credit Card used for all requirement such as fuelling up your vehicals, booking railway ticket, holiday.

5. Global classic credit card

- PNB Global classic credit card is easy to use credit card because zero joining and annual fee. The credit card provide interest free credit period, surcharges waivers on fuel, railway ticket booking etc.

- You can earn 1 reward point on Rs. 100 and get exciting offers from the reward point.

- PNB Global classic credit card used for to pay your utility bill payment i.e electricity bill, mobile/ DTH recharge, etc

6. PNB Rakshak RuPay Platinum credit card

- This credit card offers various features and benefit to their customer such as insurance benefits, reward point and cashback benefits.

- No entry fees or annual fee.

- You can get 300+ reward point on first usuage.

- Comprehensive insurance coverage.

7. PNB Rakshak RuPay select credit card

- This credit card provide cashback on utility bill such as electricity bill, mobile & DTH recharge, reward point, dining expenses etc.

- No entry fees or annual fee.

- You can get 300+ reward point on first usuages and 2X reward point on retail merchandise.

- Complimentry international and domestic lounge access.

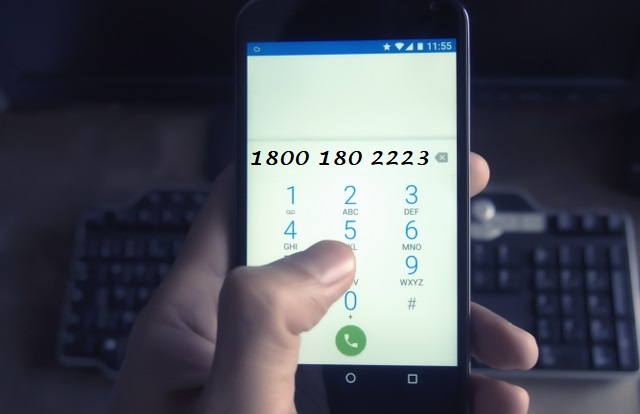

PNB Credit Card Customer Care

In case you need any help regarding credit card services or facilities, you can use following information to reach customer care.

Toll-Free Number: 1800-180-2345

E-mail: creditcardpnb@pnb.co.in