Post Office Saving Account- Online registration, Eligibility, Charges, Interest rate, Features & Benefits

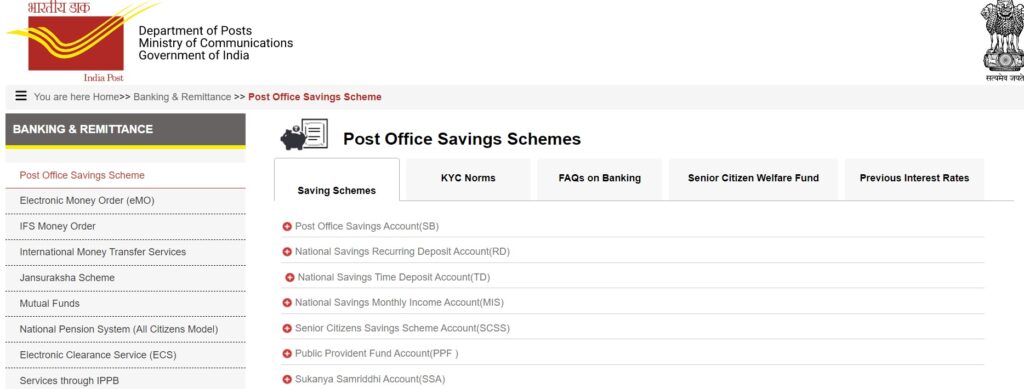

Post Office Saving Account- It is regular saving account scheme under the Government of India. India post office offers wide range of financial and retail services to their customers such as saving account for specific age group, premium public provident fund (PPF) and national scheme certificate (NSC).The saving account scheme is beneficial for all type of investment with minimum risk, the fixed interest rate is at 4% for single or joint account holder.

India post office also provide digital banking solution to the customers via internet banking, mobile banking facilities. Using this you can transfer fund to any post office, get mini statement online, pay electricity bills, etc. Let’s see the detail process of post office saving account.

Table of Content

1. How to Open Post Office Saving Account

2. Eligibility to Saving Account

3. Post Office Interest Rate

4. Post Office Saving Account new Charges

5. How to Activate Post Office Internet Banking

6. How to Login Post Office Internet Banking

7. Features & Benefits

8. FAQs

How To Open a Post Office Saving Account

Step 1: Visit the nearest post office or official websites of India post i.e www.indiapost.gov.in and get the application form.

Step 2: Fill up the application form with complete details. Submit it along with necessary document and passport photograph.

Step 3: Now you have to pay a deposit amount of Rs.20 for saving account without the cheque facility or deposit amount of Rs.500 for saving account with a cheque facility.

After the successfully complete procedure, your account will be open within 2 days.

Post Office Saving Account Form Download

The account opening application form is available at all the Post offices and India post website. You can visit the nearest post office branch or download it from below.

Eligibility to Open Saving Account

- Individual can open single or joint account in post office.2

- You need to be Indian and an adult.

- A guardian can open the saving account in the behalf of minors. In case minors need to open saving account,

- He/she must be above the age of 10 years.

- Post office account opening nomination is mandatory.

Post Office Saving Account Interest Rate

The Central Government decides the interest rate on post office, banks. Currently post office interest rate is 4% which is calculated every month. Interest rate will be calculated on the basis of minimum balance of account holder. According to Income tax regulations, if account holder generates return less than Rs. 10,000 a year through interest, then it is tax-free. You can also check interest rate for various scheme is given below.

| S.No | Investment scheme Option | Rate of Interest (p.a) |

| 1 | Public Provident Fund | 6.4% |

| 2 | Senior Citizen Savings | 6.5% |

| 3 | Kisan Vikas Yojana | 6.2% |

| 4 | Sukanya samridhi Yojana | 6.9% |

| 5 | Post office monthly Income | 5.7% |

| 6 | National Saving Certificate | 5.9% |

Post Office Saving Account Charges

The post office saving deposited amount can be withdrawal at anytime as per customer need. According to India post the new charges will apply on saving account scheme from 1st April 2021.There is no charges on basic saving account for withdrawing cash upto four times in a month. After that every transaction will be charged Rs. 25 or 0.25 percent of the total amount withdrawn.Saving and current account holder has no charges on withdrawing up to Rs. 25000.

How to Activate Post office Internet Banking?

Now you can get the saving account details online via internet banking. Internet banking is secure and simple way to all banking transaction. To activate post office internet banking you need to PAN number, active mobile number, KYC document, email ID then proceed further.

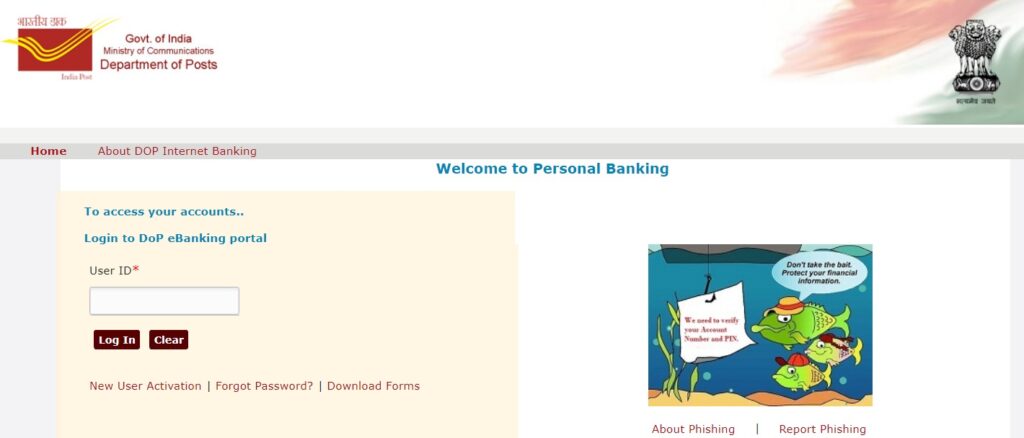

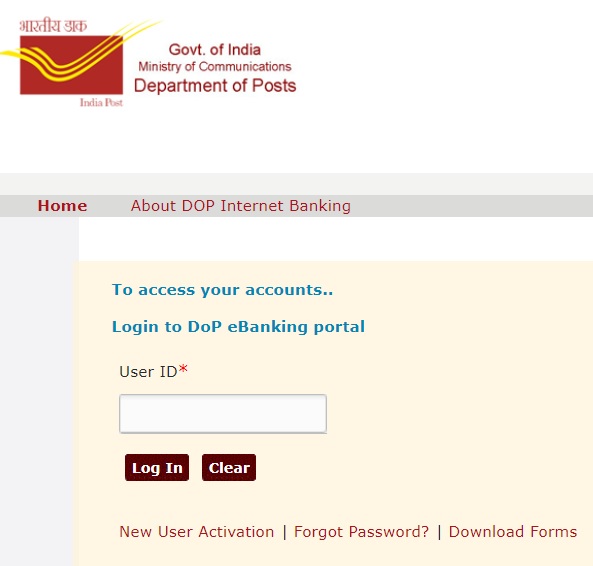

Step 1: Visit the India Post Internet Banking.

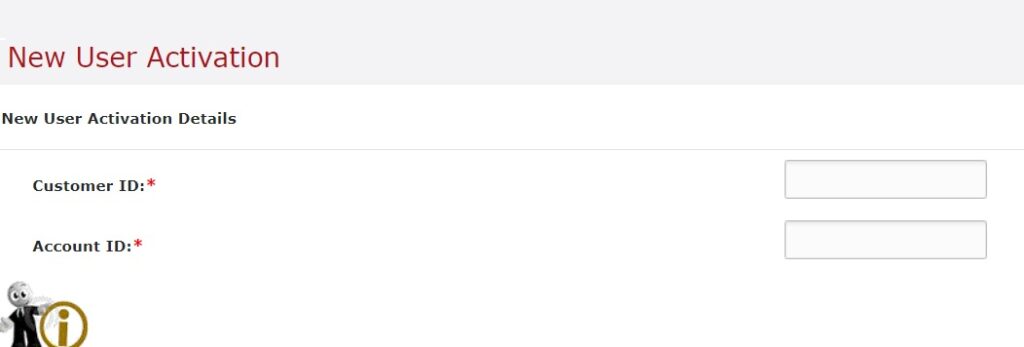

Step 2: Click on New User Activation.

Step 3: Enter your required details such as customer ID which is CIF ID printed on the first page of your passbook. The account ID is your saving account number. Click on submit.

Step 4: You have to set up your login and transaction password and security question as well. [In case you forgot the password, security question will help to reset your password.]

Once the registration done successfully, the confirmation message will send to your registered mobile number or email id address.

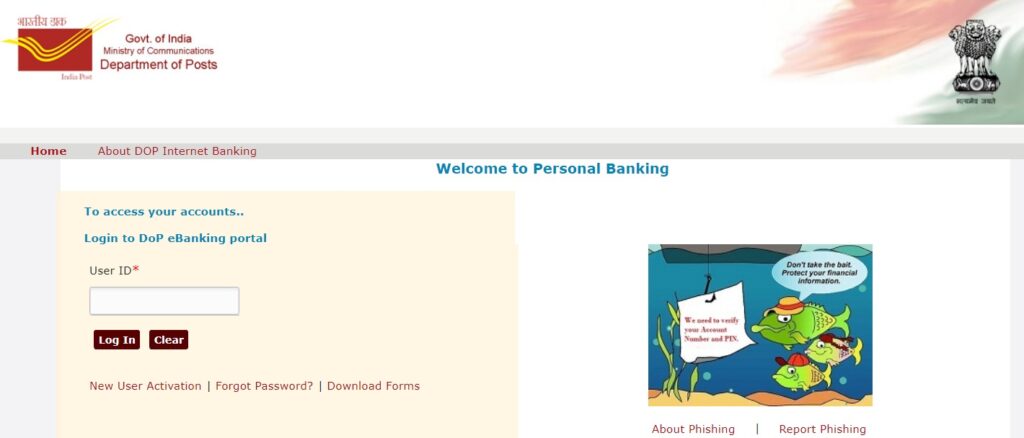

How to Login Post Office Internet Banking?

To access saving account online, you need to login for internet banking facility which provided by India post. Follow the given simple steps.

Step 1: Visit the post office internet banking login portal.

Step 2: Enter your user ID and click on submit option.

Step 3: After you logged in to internet banking you can easily perform banking activities and transaction.

Features & Benefits

ATM/Debit card : You can use debit card or ATM for banking activities as per convenience. For that you should rquired minimum balance in your saving account.

Minor Accounts : Minor user can open single or joint account in India post office but after the age 18+ minor need to apply freshly for their account.

Aadhaar Seeding : The Government has made mandatory to link aadhaar card to saving account.

No lock in period : There is no lock-in or maturity period unlike fixed deposit scheme. It works like other saving account in scheduled bank.

Different Scheme : Post office offers different investment scheme for their customer such as PPF, NSC. The rate of interest on the scheme is better than any other investment.

Active account : To maintain your saving account you need minimum balance in saving account to carry out deposit or withdrawal of amount.

Easy bill payment and recharge

ebanking/mobile banking

FAQs

Ans- Yes, you can open RD & TD account through internet banking.

Ans- To open post office saving account you need to following document aaddhar card, PAN card or electrcity bill, bank passbook, salary slip with current address.

Ans- Yes, you can shift your saving account to any post office.

Ans- Yes, you can change user id as well as password.

Ans- You can get cheque system facility of through application form SB/CQE-4 and requisition for fresh cheque book on form SB/CQE-4A.

Ans- The minimum balance required to maintaining post office saving account is Rs.500.

Ans- You can get new duplicated passbook only at home branch of post office.

Ans- You can open only one account as individual or joint account at post office.